Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

Nielsen's recently-released Total Audience Report for the 4th quarter 2016 held few surprises for people who follow the numbers, not the hype. As with all their previous iterations, the Total Audience Report found that although inroads continue to be made by alternate viewing sources, people still spend the majority of their media time with traditional "live" TV. In fact, people spent roughly half as much time with the second runner up, using an app or accessing the web—including watching videos—through a smartphone. And in third place, radio continues to hold its own, a fact that no one outside of radio seems to care about. And, as always, younger consumers spend more time with digital media than older ones.

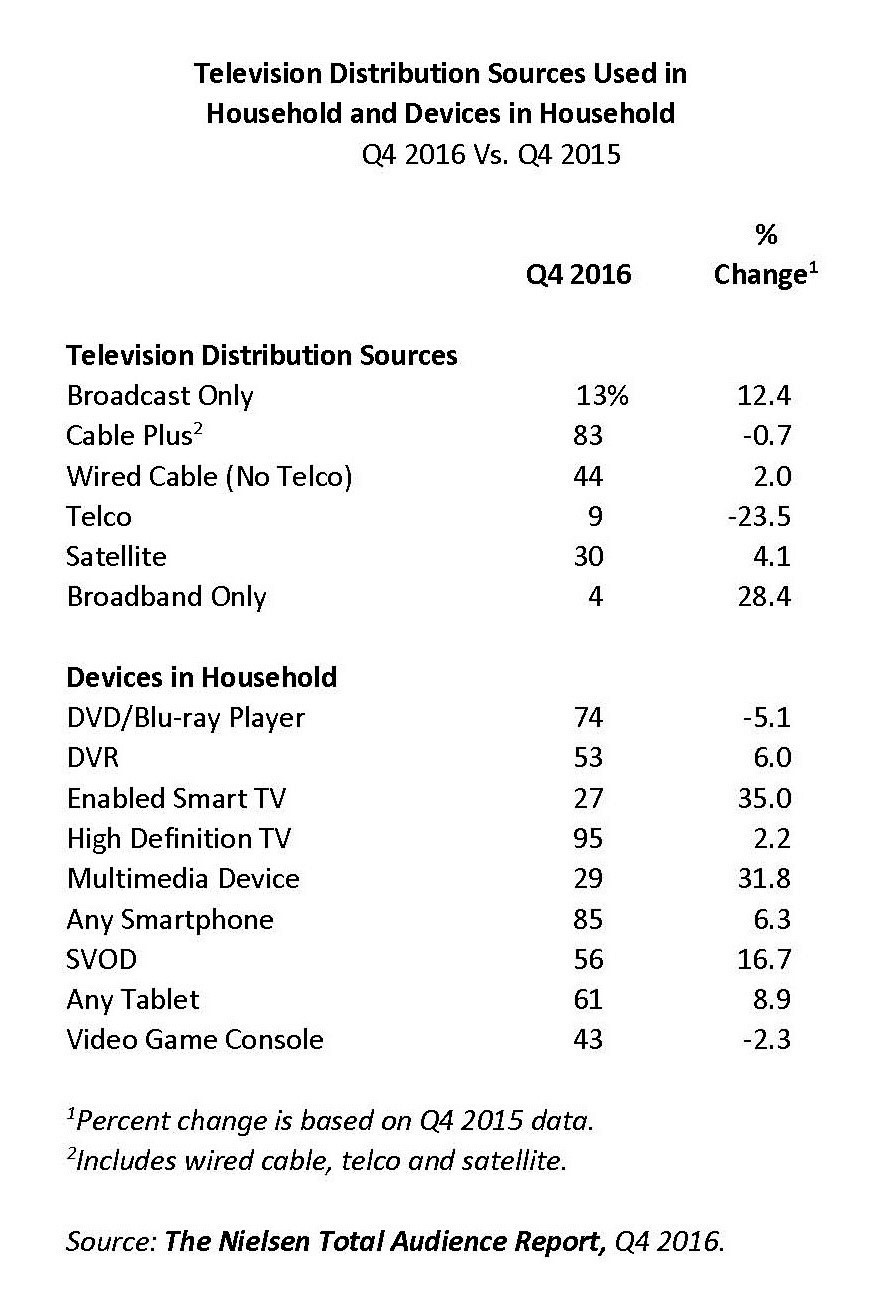

There was, however, some interesting data about households and how they access TV/video content and, on a related note, the penetration of devices that allows them to do so. As shown in the accompanying table, among television distribution sources in U.S. households, telcos (e.g. Fios) suffered the most precipitous declines, with nearly 24% fewer homes using this means of access in the 4th quarter 2016, compared to a year earlier. And the number of households using broadband-only grew the most in the same period, up 28%. Among household devices, ownership of DVD/Blu-ray players and video game consoles is down (as streaming access continues to grow). On the other hand, Smart TVs (TVs capable of and enabled to access the Internet) and multimedia devices (Apple TV, Roku, and TVs with computers/laptops/smartphones connected to them) both saw double-digit gains in the past year. Clearly, households are investing in technology that allows them to access programming on their own terms, be it through network websites or apps, SVOD services like Hulu, or video content on YouTube. If you want to see the direction TV is heading, you only need to follow the money.

Q: Is An Online Upfront Possible?

A: We doubt it. For years, magazine sales executives have tried to get in on TV's annual upfront buys, without realizing that these are executional, not planning operations. The national TV budgets for the upcoming season have already been mandated, and the buyers are merely handling the negotiations to make the buys happen. There is no room for another medium to

get a piece of the action.

It's also doubtful whether online sellers could organize their own upfront to capture ad dollars well before the fact. To begin with, unlike TV's :30s or magazines' P4Cs, the Internet lacks a standard ad unit that everybody uses when making their budgets. Also, unlike TV, online ad time is not perishable; you can get whatever you need, whenever you need it.

Finally, the TV networks all operate by the same rules of conduct, offering similar packages, audience guarantees, post-buy adjustments, etc. In contrast, online ad sellers function independently, which makes it virtually impossible to orchestrate an upfront buy, even if

such a venture seemed feasible.

Q: Why Don't Branding Advertisers Appreciate The Merits Of Online Advertising?

A: If we are talking about the advertiser's promotional people, it's fair to say that they do appreciate the benefits of online advertising, particularly its instant response and interactive aspects. This shouldn't be surprising, since such people come from disciplines where responses are rapid and measurable. On the other hand, branding executives have longer-range goals and perspectives. They are concerned primarily with building a brand's image and positioning it in a way that will motivate current users to keep buying (reinforcement) and non-users to try the brand. These goals take time to attain, and results are not always instantly measurable. As a result, branding people track awareness, sales point registration, intent to buy and similar metrics, which, if they trend in a positive direction over the course of some months, will probably generate a sales, or share of market lift.

The problem for the Internet is that although branding and promotion are supposedly coordinated at the client marketing level, they often function independently, with the branding campaign providing umbrella coverage for more targeted promotional efforts designed to stimulate short term boosts in sales. As a rule, separate agencies handle each function, and have different chains of command. This makes the strategists (branding) less inclined to try new approaches without past precedents to guide them, while the tacticians (promotion) are more likely to test any alternative options that appear to hold promise to see if any work.

Because of the split personality in their organizations, many advertisers have been slow to investigate the merits of online ad campaigns that focus primarily on branding. Internet ad sellers have compounded the problem with viewability issues, by relying on strange new metrics and by failing to recognize the branding advertisers' ingrained concerns about modes of communication, ad visibility, clutter, etc. Hopefully, once these issues have been resolved, this medium will become ad friendly.

Q: Can Addressable Advertising Work for The Internet?

A: The core idea is simple. Send an ad message only to consumers who are interested in a specific product or service. The Internet should be ideally suited for such ventures and, in fact, already performs such functions for advertisers. The Internet approaches the addressable idea far more precisely than TV does. Instead of assuming product interest based on broad demographic match-ups, online search engines identify specific users who search for particularly relevant items of information or visit websites about related subjects, and send them the advertiser's ads. There is no guessing or assumptions; the advertiser knows which computer it is targeting and what information searches and websites have been accessed on it. If a user has visited a number of sports car websites recently, plus done research about various makes, prices, etc., this makes him an active prospect for a sports car brand's online ads (to a far greater degree than blithely assuming that all young or affluent males are prospective buyers). Indeed, an online addressable campaign can target potential buyers based on their frequency of searching relevant subjects or website visits, giving the advertiser a way to fine tune his promotions for even greater immediate impact.

Why isn't even more of this being done? First, online sellers seem to be response-oriented, waiting to be asked, rather than aggressively organizing and selling such proposals. Often, the call from the agency or advertiser just doesn't come and the opportunity is lost. Second, advertisers want addressable video ads, not banners. To be blunt, they believe that TV-style messages are the best way to brand their products and motivate consumers. Right or wrong, they don't have similar convictions about print ads. To counter this, online sellers who wish to promote addressable ad campaigns must not only organize these proposals in a meaningful way (to accommodate 15- or 30-second ads), but aggressively sell them.

The above Q&A excerpt was originally published in The Media Book 2014, ©Media Dynamics, Inc.