Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

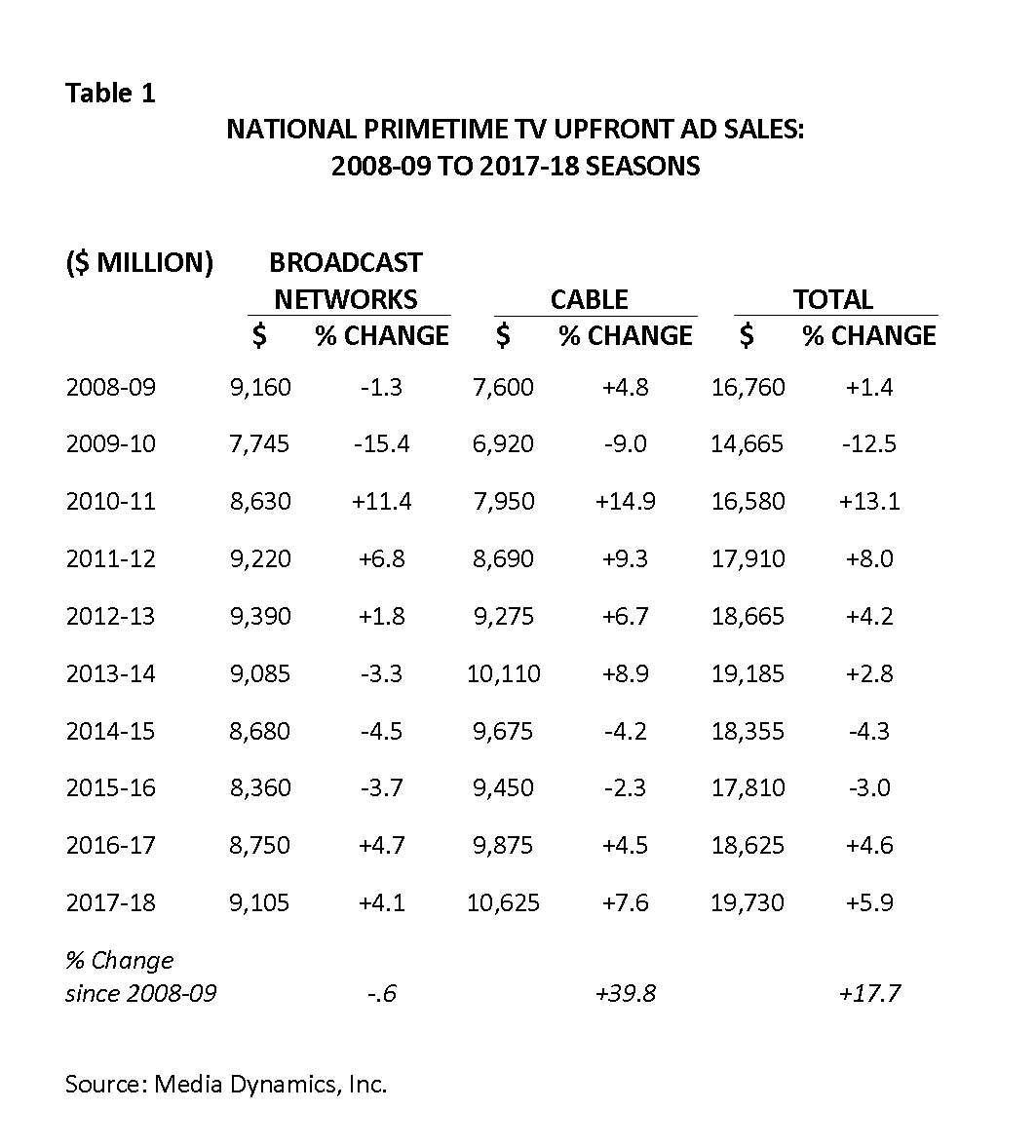

The negotiations for national TV’s primetime upfront for the 2017-18 season are complete and Media Dynamics, Inc. estimates that total ad revenue for the broadcast TV networks and cable channels amounted to $19.73 billion, an increase of 5.9% over the previous upfront. While the broadcast TV networks sold approximately $9.1 billion of time (up 4.1% over last year), cable scored bigger gains, with $10.6 billion in ad revenue (up 7.6%).

This year’s upfront is particularly noteworthy, as it included a growing number of cross platform buys (network plus cable), increased digital activity (the networks will probably sell $2.6-2.7 in digital time next season), and within the network sphere, some bundling of late night with prime.

Also included in the totals are a relatively small but growing number of so-called “advanced targeting” buys, mostly on cable channels. These utilize “big data” set usage profiling as an add-on metric to Nielsen ratings, but mainly in single seller negotiations.

“Our primary take on the 2017-18 upfront is that national TV is far from dead,” notes MDI president, Ed Papazian, “In fact, it is evident that a number of major branding advertisers have decided that they have no alternative but to continue to use TV as their primary communications platform—despite rating fragmentation and increased CPMs—due to its huge reach advantage over digital media, as well as the fact that every TV commercial is fully visible. This does not preclude them from using digital media, especially videos, but in a complimentary and supportive role to TV ad campaigns, not a substitute.”

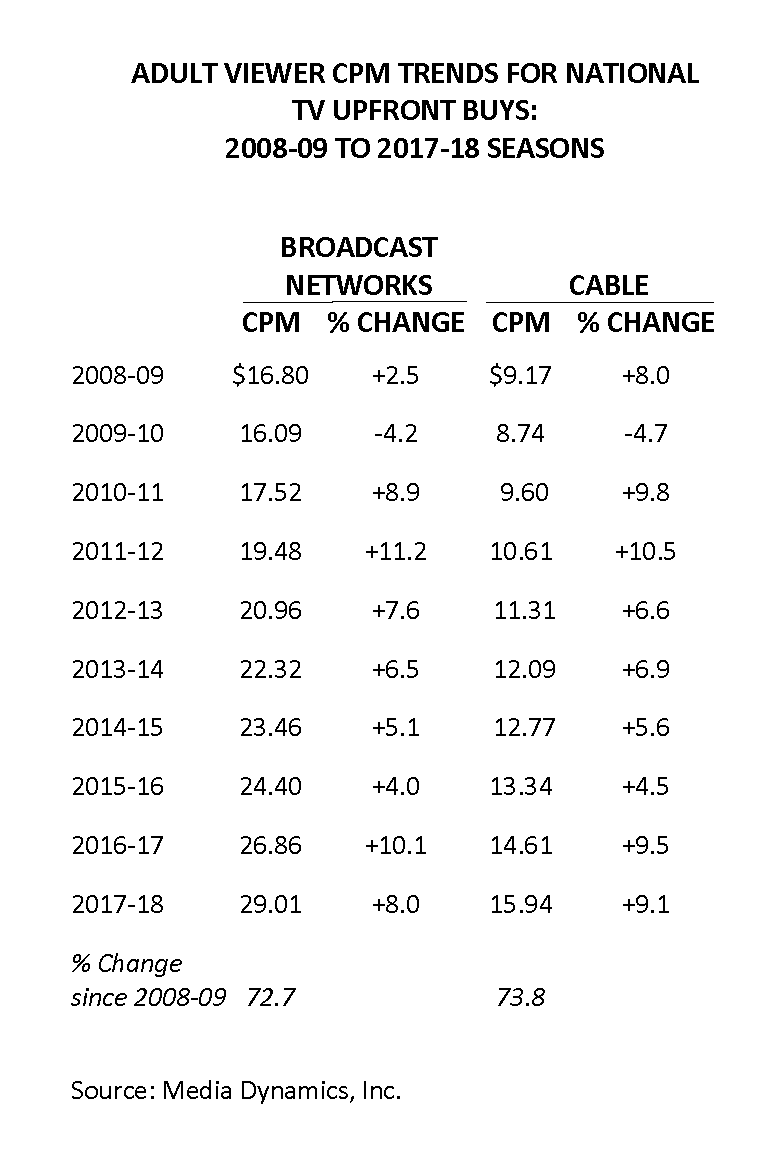

Comparing the current season of upfront ad revenues and CPMs to the 2008-09 season, MDI finds that overall primetime ad dollars rose 18% during this period. The lion’s share of this gain went to cable, which saw a 40% increase in ad revenue, while broadcast remained relatively flat. In terms of adult (18+) CPMs, however, both broadcast and cable saw increases of 73-74% during this period.

It should be noted that MDI’s estimates are preliminary in nature and subject to revision, especially for cable. A more detailed report, TV’s Upfront 2017-18, and ACES 2017-18 CPM-CPP estimates are just released and CPMTrack will be available in and mid-August.