Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

Nielsen's second quarter 2015 Comparable Metrics Report reported that its electronic measurements recorded surprisingly low levels of streaming activity, via its electronic measurements, compared to information provided on the same subject by surveys relying on respondent listening claims.

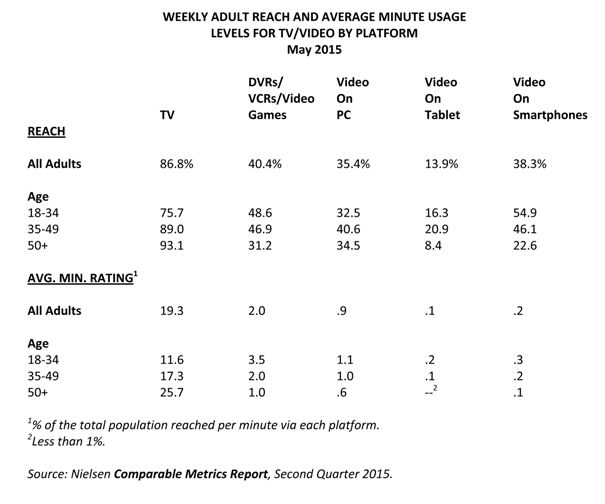

Radio, defined by Nielsen as AM/FM stations, reaches 93% of all adults weekly and an average listener devotes 13.9 hours to such stations. In contrast, 18.9% of adults streamed audio on their smartphones, 8.6% on PCs, and a mere 2.6% through tablets. As shown in the accompanying table, the amount of time devoted to audio per streamer was very small relative to AM/FM radio outlets. In fact, based on the data in the table, we can calculate that the former drew 96.7% of all activity (Table 1).

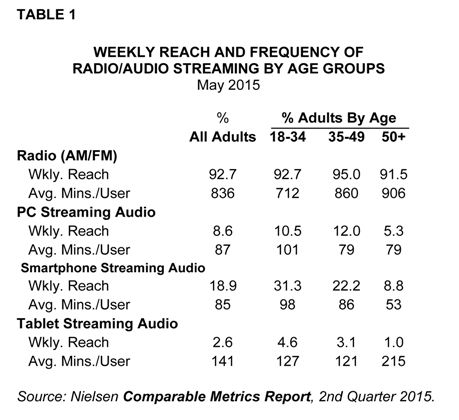

While it is not surprising to see the youthful bent of the streaming audience as shown in Table 2, we wonder whether Nielsen's streaming measurements are missing a good deal of activity that occurs at work or at other venues, using devices outside of Nielsen's purview. Hopefully, such questions will be raised by streaming audio ad sellers and other interested parties.

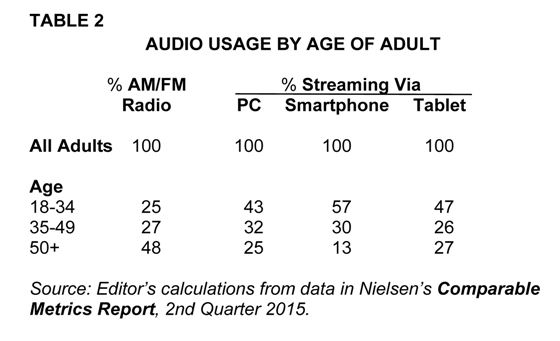

While the media trade press continues to be abuzz with stories highlighting the rising use of alternative TV/video platforms, which are eroding the once-dominant position of "traditional" TV, it is useful to take a longer and more detailed look at the stats behind these claims. For example, Nielsen's Comparable Metrics Report for the second quarter of 2015 (citing meter/electronic-based data for a typical week in May 2015) indicates that 40% of all adults used their DVRs/VCRs or video game consoles at least once a week to access TV/video content. Comparable reach figures for viewing videos on PCs, tablets and smartphones were 35%, 14% and 38%, respectively. In comparison, traditional TV's weekly reach was 87%.

When trending such data, it is clear that alternative venues are increasing in usage hence the rumored death knell for traditional TV as reported in the trade press. But it is worth going beyond the reach comparisons to examine the effects of frequency. While traditional TV viewing is indeed declining in terms of total time spent, it is a very slow, drawn out process, not an abrupt plunge. In fact, when Nielsen calculates the impact of the various platforms in terms of volumetrics (reach x frequency), it is clear that traditional TV retains its dominant position, even if its ratings are increasingly fragmented.

The accompanying table demonstrates this, showing the weekly reach of each platform for adults in total and by age, including average minute usage rates ("ratings") for each platform on a total population basis. For example, according to Nielsen, 19.3% of all adults were watching traditional TV per minute across all dayparts. By comparison, only .2% (or two persons per thousand) were watching videos on a smartphone.

As the table reveals, Millennials are least likely to be watching traditional TV content, and most likely to be accessing content through other means. In fact, Millennials use their smartphones 50% more frequently than the all-adult norm. But translated into actual audience tonnage, this represents an average minute rating for Millennials of only .3%, compared to 11.6% for traditional TV. So if you sampled 1,000 18-34s per minute across a 24-hour period, you would find 116 watching TV and three accessing videos on their smartphones.

The point is while there's little doubt that the percentage of TV/video time we allocate to traditional venues is slowly declining, there's no reason to give up on traditional TV just yet. Heightened competition always causes audience erosion, which is what we are seeing; but in order for the alternative venues to supplant traditional TV, they will need much more and better content that covers all forms of programming, not just dramas and comedies. This includes news, sports, documentaries, game shows, reality and talk, all of which people want and need; all are necessary to create the kind of viewing environment conducive to sustained and engaged consumption. This may not be in the cards, at least to the extent that the "TV is dead" folks believe.