Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

An EXCLUSIVE Excerpt from the forthcoming TV Dimensions 2017

One of the burgeoning challenges that broadcast TV networks and national cable programmers are facing is competition from subscription-video-on-demand (SVOD) services. Judged by any standard, the growth of SVOD services in the past five years has been both impressive and rapid. In 2010, only 20% of U.S. TV homes subscribed to any of these services; we place total SVOD user penetration at around 57% of all U.S. TV homes by the end of 2016. Most of these gains will be spurred by Amazon, Hulu and the newer SVOD services; Netflix, which is now surging in international markets, will see its U.S. growth rates diminish.

There are a number of theories about the SVOD phenomenon. One school of thought believes that, thanks to rising ad clutter on traditional TV, a large part of the population—especially younger, better educated adults—is fed up with commercials and is rebelling by fleeing to SVOD, particularly Netflix. While an aversion to TV ads is undoubtedly part of the motivation to subscribe to Netflix, we believe there are two, more crucial factors. The first is the formulaic, highly predictable nature of broadcast network fare, and the resulting desire for different, edgier content (which can be found in much of the original programming produced for SVOD services, as well as on some cable channels). The second is the obvious appeal of being able to watch content on demand.

Over the past several seasons, the broadcast TV networks' average minute 18-49-year-old primetime ratings have declined by about 7-8% on an annual basis. We suspect that roughly 65% of this audience loss was due to defections to SVOD, while the remainder could be attributed to general rating fragmentation, mostly going to cable. Obviously this is not a positive development for the broadcast networks, and it is unlikely they will be able to turn things around in primetime unless they radically alter their program development strategies, stop thinking that they are still "mass audience programmers," and seek out a new breed of producers who can create intellectually challenging content.

On the plus side for linear TV, it is important to recognize that broadcast network primetime programming, while generating a lot of buzz, is only one component of the overall picture. Even if the networks lost every one of their average minute primetime viewers to SVOD—a very unlikely development—this would not mean the demise of traditional TV as a whole. TV is simply too big and diverse for that to happen.

Finally, the TV "Establishment" is at last wising up about SVOD. CBS has announced the launch of a new Star Trek series on its own SVOD service, CBS All Access. Unlike Netflix, the broadcast TV networks and some of the major cable programmers are well placed, both in terms of experience and the existence of available content, to expand rapidly into the SVOD area. If CBS's outcome with Star Trek is positive, other networks will begin to launch original primetime series in the same manner, exploiting two revenue streams (SVOD, followed by "reruns" on linear TV) to make them less reliant on ad dollars while increasing their profit margins.

The forthcoming TV Dimensions 2017 includes the complete version of this whitepaper along with two tables detailing our own independent projections of U.S. TV homes accessing SVOD services and average minutes of daily TV/video viewing per adult.

TV Dimensions, a staple in the media and advertising business for over 30 years, continues to cover the basics our readers expect: ad revenue and CPM trending, TV viewing patterns and demographics, viewer involvement and engagement, and an in-depth chapter on how TV ads work. All fully revised and updated.

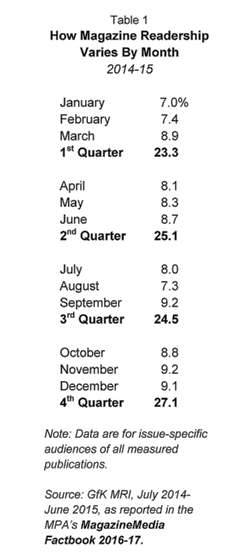

We recently took another look at the MPA's MagazineMedia Factbook 2016-17, and found an interesting tidbit buried at the end of the report that we feel is worth highlighting because it flies in the face of conventional wisdom. It's generally believed that magazine readership holds fairly steady throughout the year, compared to television, for example, which generally drops off during the summer months. However, according to the findings reported in the Factbook, there is variation. On a quarterly basis, the fourth quarter ranks highest, at 27.1%, 16% less than the first quarter, where only 23.3% reported reading a specific issue of a magazine. Fluctuations were even greater on a monthly basis, going from a low of 7% in January to 9.2% in both September and December, a 31% difference (see Table 1).

What does this tell us? In particular, the upswing in readership from September-December ties in with back-to school and the holidays, suggesting a positive synergy between the medium and seasonal shopping patterns. And no one can argue the appeal of a well-executed spread on the fashion trends, savory holiday foods or the latest holiday decorations. But there are also bumps in March (8.9%) and June (8.7%), perhaps presenting advertisers with an opportunity to exploit the beginning of spring and summer with seasonal shopping enticements.

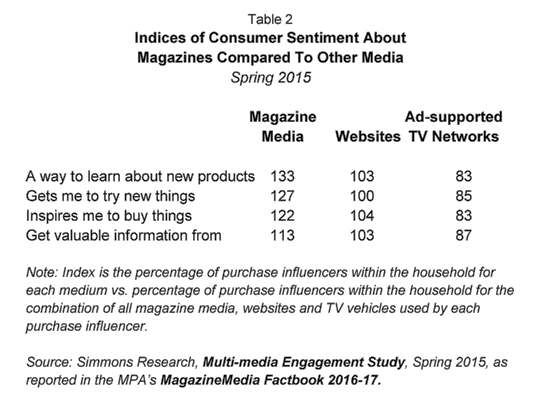

The MPA's annual report confirms what is well known: that magazines resonate more than other media as a source for consumer information and buying motivation (see Table 2). Magazine readers enjoy reading their favorite titles and garnering information and ideas about topics they're interested in; ads that appear in this setting "blend in" and become part of the overall experience. Adding the seasonal bumps in readership could be viewed as the icing on the cake, within this context.

But…media experts already know that. Agencies know it. Advertisers know it. They also know that magazines lack the caché of television or electronic media in its many forms. So it's up to the magazine industry to do more than just show them the numbers. They've got to generate enthusiasm about the positive attributes they offer. The question is, how?