Media Matters goes beyond simply reporting on current trends and hot topics to get to the heart of media, advertising and marketing issues with insightful analyses and critiques that help create a perspective on industry buzz throughout the year. It's a must-read supplement to our research annuals.

Sign up now to subscribe or access the Archives

As their in-home ratings continue to decline, the TV networks and cable channels have become increasingly interested in finding ways to accurately measure and monetize their out-of-home audiences. Although Nielsen's peoplemeter panel attempts to include viewing by visitors to a home, it cannot offer any insights for viewing that takes place in hotel rooms, offices, bars and restaurants, and other out-of-home locations.

Based on data from occasional out-of-home viewer diary or telephone studies, we estimate that such exposures add about 2% to in-home viewing levels, with much of it occurring when visiting someone else's home. For example, a 2006 Arbitron telephone survey of several thousand persons aged 12+ found that 13% of its respondents claimed to have watched TV in some away-from-home location in the past 24 hours, and the average time spent viewing was one hour and 45 minute; this contributes the aforementioned two percent to the overall viewing for the total 12+ population.

Many cast doubt on the veracity of human respondents such studies claiming inaccurate or exaggerated self-reporting. The inclination is instead to use so-called passive electronic methodologies that don't require direct human cooperation to gather data. In 2008, Nielsen conducted such a study on an experimental basis in several markets. A sample of persons aged 13-54 was recruited to carry special smartphones that were capable of capturing audio signals from TV sets that allowed researchers to identify which channel was on. If an active channel was picked up, it was assumed that the person carrying the smartphone was "watching." Across a full day, this experiment found an average lift of 2.6% over the in-home viewing level reported by peoplemeters in the same markets.

A spring 2014 Nielsen experiment, conducted in Chicago using the Portable Peoplemeter (PPM) technology it acquired when it bought out Arbitron, took the out-of-home viewing question a step further. The PPM is another passive measurement system, where a panelist carries or wears a pager-sized PPM that can pick up audio signals embedded in the emissions of TV stations and cable channels. If the PPM picks up these signals, it is assumed that the panel member was "watching."

What's different about this Nielsen study is the magnitude of the reported out-of-home viewing lift that was noted among adults aged 25-54. Across all dayparts, it averaged between 7-9%, or roughly triple the previous findings.

Needless to say, the TV networks and cable channels—especially those carrying a lot of sports programs—are thrilled by such results. For now, they can attempt to charge advertisers for these "bonus" audiences, which tend to comprise more desirable younger and upscale demos.

But are such findings credible? If we believe that the average person aged 25-54 adds 8% to his/her viewing through out-of-home exposures, this translates to roughly four hours of away-from-home viewing per week per person, and that's for all adults aged 25-54, not just those who view in away-from-home locations. If we estimate that roughly a third of this group watches TV at least once a week away from home, this means that the average consumption rate for those viewers is 12 hours per week. That seems like a lot, doesn't it? There is no denying that TV sets have become available in more and more out-of-home locations and there is more program content catering specifically to such venues; however, the 8% estimate from Nielsen's Chicago study refers to the added audience attained by regular broadcast and cable shows, not by other forms of content.

The crux of the problem is the use of a passive measurement system. At least with Nielsen's in-home peoplemeter, a panel member must indicate that s/he is "watching" when the meter notes that a set is turned on or that the channel's been changed. With the PPM, viewing is assumed based solely on proximity to the encoded signal being broadcast. But is being close enough to pick up the signal the same as actually watching?

We can accept that out-of-home viewing is on the increase, and that the TV networks, stations and cable channels may not be reaping the full rewards of their "total" reach in terms of ad dollars. But we also feel that it's well past time for advertisers and agencies to demand validation of the PPM findings, especially because they will be projected as add-ons to in-home peoplemeter results, which are based on a different methodology.

Probably the best way to conduct such a validation would be to take a sample of peoplemeter panelists, representing all sex/age groups, including 55+, and determine to what extent they can "verify" their exposure. For example, a peoplemeter panelist would be called on the phone or queried online about which TV shows were seen the previous evening. Whenever a particular program was cited, the viewer would be asked to recall key portions of its content. Later, the actual peoplemeter findings of the same person would be compared to the phone/online survey results. The same procedure could be followed for PPM panel members, with a focus on the location of their exposure.

Suppose such a study were conducted and, on average, 78% of in-home and out-of-home viewers could accurately recall the shows they had been recorded as watching. If that was the case, we might well assume that the PPM out-of-home findings were compatible with the peoplemeter results. But what if 78% of the peoplemeter-recorded in-home viewers could play back enough content to prove they were watching, while the corresponding figure for out-of-home via the PPMs was only 40%?

We believe that having data—a lot of it—is probably a good thing, but let's not lose sight of the importance of validity.

Have Millennials really deserted traditional TV? With all of the speculation about linear TV losing its audience to stand-alone ad-free services like Netflix, we thought it would be interesting to take a look at the available stats from a number of sources and see what the current situation really is.

This is a fairly complicated analysis, as non-commercial forms of linear TV, such as public television and premium cable channels like HBO, are included in the overall TV usage compilations. TV exposure through streaming video subscription services like Netflix and digital video venues like YouTube must also be factored in, as well as the dwindling but still measured exposure through DVDs and BluRay.

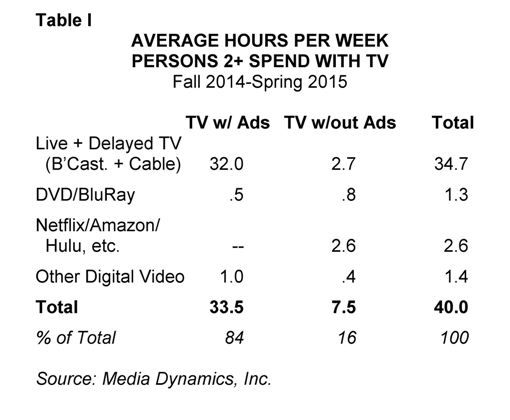

Once all of these forms of TV/video are added together, we found that the average person aged 2+ spends about 40 hours per week watching TV, and approximately 7.5 hours, or 16% of all viewing was ad-free TV (see Table I).

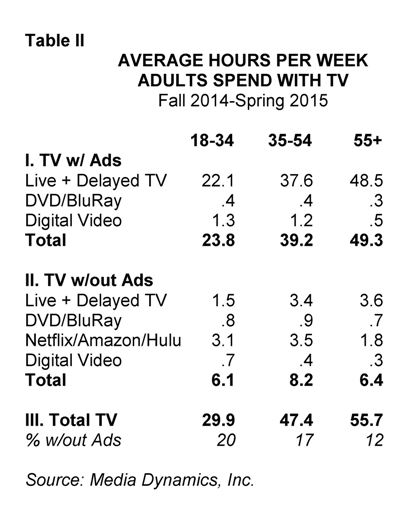

We extended this analysis by age groups to explore the much-discussed defection of 18-34s, who are said to be abandoning traditional TV in droves. And yes, the data clearly indicate that Millennials are less likely than their older (55+) counterparts to allocate their viewing time to commercial television. Specifically, about 20% of the typical Millennial's total TV consumption was to ad-free content, whereas only 12% of the viewing done by the average person aged 55+ was to such channels or platforms (see Table 2).

It should be noted, however, that Millennials still devote 22 hours per week to linear TV, compared to only three hours to Netflix/Amazon/Hulu, whose combined penetration is only 40% nationally. While this figure is expected to increase to somewhere in the low 60% range over the next five years—aided by new subscription video-on-demand (SVOD) services being launched by CBS and other programmers—it would appear that traditional TV will continue to dominate time spent viewing or "tonnage" stats of 18-34-year-olds for a long time to come. As for adults over the age of 35, additional attrition of linear viewing will also be seen among this segment, but their overall reliance on traditional TV is, and always has been, greater.

Obviously the broadcast TV networks and stations, as well as ad-supported basic cable channels are concerned about audience losses they may suffer. The rise of SVOD services, in particular, represents a palpable long-term threat, especially for traditional TV programmers who target younger viewers. One would think that the powers-that-be in broadcasting and cable would recognize this while there is still time, and take steps to put some real balance in their schedule by adding trendy, edgier and smarter fare that might attract a majority of their viewers from the under 40 crowd, instead of the usual array of reality talent shows, law and order procedurals and generic sitcoms, most of which generate median viewer ages in the 50-60 range.